The Biweekly Mortgage – Who Needs It?

Have you received an advertisement offering to save you thousands of dollars on your thirty-year mortgage and cut years off your payments? With email spam becoming more pervasive as everyone tries to get rich quick on the Internet, these ads are popping up with troublesome regularity.

Have you received an advertisement offering to save you thousands of dollars on your thirty-year mortgage and cut years off your payments? With email spam becoming more pervasive as everyone tries to get rich quick on the Internet, these ads are popping up with troublesome regularity.

The ads promote a Biweekly Mortgage and for the most part, do not come from a mortgage lender. Exclamation points punctuate practically every claim:

- No closing costs!

- No refinancing!

- No points!

- No credit check!

- No appraisal!

- Save thousands!

- Cut years off your mortgage!

To achieve these wonderful savings all you have to do is allow half of your mortgage payment to be deducted from your checking account every two weeks. It’s easy. Of course, there is a small set-up fee and usually a transaction fee with every automatic deduction.

Essentially, the ads are truthful in almost every respect.

They just want to charge you money for something you can do on your own for free.

The Basics:

Normally, you make twelve mortgage payments a year. Since there are fifty-two weeks in a year, a biweekly mortgage equals 26 half-payments a year. The equivalent would be making thirteen mortgage payments a year instead of twelve. By applying that extra payment directly to the loan balance as a principal reduction, your loan amortizes more quickly, requiring fewer payments.

You save money. The ads are true.

How it Actually Works:

You cannot simply mail in half a payment every two weeks to your mortgage lender. Since they do not accept partial payments for legal and accounting reasons, the mortgage company would just mail your half-payment back to you.

Instead, the biweekly mortgage company is an intermediary between you and your mortgage lender. They automatically debit your checking account every two weeks for half of your mortgage payment then place your funds into a trust account. Basically, this is just a holding account for your money. In another two weeks, there is another automatic deduction from your checking account, and so on. When your mortgage payment is due, your funds are withdrawn from the trust account and forwarded to your mortgage lender.

Since you are placing funds into the trust account faster than your mortgage payments are due, you eventually accumulate enough money to make an extra payment. The way the cycle works, this occurs once a year. he extra payment is applied directly to your principal balance, which causes your loan to amortize faster, pay off more quickly and save you thousands of dollars.

Potential Problems with the Trust Account

Because your funds are held in the trust account until your mortgage payment is due, there are potential dangers. Not only are your funds held in this account, but so are the funds of everyone else enrolled in the biweekly program. That is a lot of money.

Most likely, there will be no problems.

However, if there are accounting errors, mismanagement, or even fraud, your mortgage payment might not get made. The first hint of a problem will probably be a phone call or letter from your mortgage lender, but not until after your payment is already late. Since responsibility for making the payment rests with you and not the biweekly payment company, you may find yourself digging into your personal savings to make the payment directly — even though the biweekly payment company has already collected your funds.

Later you can work out the trust account problem with your biweekly payment company.

The Cost of the Biweekly Mortgage

There is usually a set-up fee that runs between $195 and $350, depending on how much sales commission is paid to the individual or company setting up the account for you. You also pay a transaction fee each time there is an automatic deduction from your checking account and sometimes also when the payment is made to your mortgage lender. There may also be a periodic maintenance fee.

Meanwhile, whoever controls the trust account is earning interest on your money.

Savings of the Biweekly Mortgage

By making principal reductions using the biweekly mortgage program, your mortgage will amortize more quickly, saving you money. How quickly your loan pays off depends on your interest rate and when you begin making the biweekly payments.

On a $100,000 loan at an interest rate of eight percent, your first principal reduction would probably be a year from now. Assuming the principal reduction is equal to one monthly payment ($733.76), you would save $43,852 over the life of the loan and pay it off almost seven years early.

However, you have to deduct from those savings any amounts you paid in set-up, transaction, and maintenance fees.

No-Cost Alternatives to the Biweekly Mortgage

Instead of hiring a company to manage your biweekly payment, you could accomplish essentially the same thing on your own for free. Just take your monthly payment, divide it by twelve, and add that amount to your monthly mortgage payment. Be sure to earmark it as a principal reduction.

The first way you save is that you do not have to pay any fees to anyone. It’s free.

In addition to not paying fees — using the same example as above — your total savings on the mortgage would be $45,904. Plus the loan would be paid off three months quicker than with the biweekly mortgage. The reason you save more is because you are making a principal reduction each month, instead of waiting for funds to accumulate so that you can make one principal reduction a year.

Self-Discipline?

The biweekly mortgage companies claim that homeowners are not disciplined enough to follow through with principal reduction plans on their own. They suggest the reason for setting up the biweekly mortgage enforces discipline upon you, and by doing so, they save you money.

However, in this technologically advanced age, banking online and automatic deductions are readily available. You can set up your own automatic deductions including the additional principal reduction and have it go directly to your mortgage lender. Since the deduction occurs automatically, just like with the biweekly mortgages, self-discipline is not a problem. Once again, you don’t have to pay anyone to do it for you and you save even more money.

Conclusion

The biweekly mortgage plans do not really do anything except move your money around and charge you for it. Plus, even though the danger is negligible, you must trust someone else to hold your money for you. If you can do the very same thing for free, plus save yourself even more money by doing it on your own, why pay someone else?

The biweekly mortgage plan – who needs it?

If your goal is principal reduction and saving money, then it is a good plan. If you do it on your own instead of paying someone else to do it for you, then it is a great plan.

Downsize Your Home Right-Size Your Life

When you’ve lived somewhere for many years, it can be tough to say goodbye. But if you (or a loved one) currently have a home that is bigger than necessary or is too high maintenance, it may be time to trade unused square footage for a smaller, more manageable space.

When you’ve lived somewhere for many years, it can be tough to say goodbye. But if you (or a loved one) currently have a home that is bigger than necessary or is too high maintenance, it may be time to trade unused square footage for a smaller, more manageable space.DESIRED LIFESTYLE

Action item: Grab a pen and take some time to envision what your ideal future might look like. Write down the activities and hobbies you hope to add to your life or continue with going forward, as well as the chores and responsibilities you’d love to drop. We can use those answers to help shape your house hunt.

OPTIMAL DESIGN

Action item: Make a note of your must-keep furniture and other items. Then pull out a measuring tape and write down the dimensions. Once it’s time to visit homes, we’ll have a more accurate sense of what will fit and how much space you’ll need.To get your creative juices flowing, you may also want to flip through some design magazines that specialize in compact living or catalogs that feature space-saving furniture and accessories. If you give us a list of your favorite features, we can use it to pinpoint homes that are a good match.

LONG-TERM ACCESSIBILITY

Action item: Review the checklist below, adapted from the National Institute on Aging’s home safety worksheet, or download the full version from the agency’s website.7 Highlight the items that are most important to you. We can reference these guidelines as we consider potential homes and suggest ways to adapt a property to meet your current or future requirements.

HOME SAFETY CHECKLIST 7

BOTTOMLINE

-

Associated Press (AP) – https://apnews.com/article/lifestyle-f094372b46bae82020c174907eb953c0

-

Healthcare (Basel) – https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10671417/

-

National Poll on Healthy Aging – https://www.healthyagingpoll.org/reports-more/report/older-adults-preparedness-age-place

-

National Council on Aging (NCOA) – https://www.ncoa.org/adviser/medical-alert-systems/downsizing-for-aging-in-place/

-

National Institute of Health (NIH) – https://www.nia.nih.gov/sites/default/files/2023-04/worksheet-home-safety-checklist_1.pdf

Why Access is So Important When Selling Your Home in Minnesota

Access Is Important When Selling Your House

If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to make your house easy to tour.

Spring is the peak homebuying season, so opening up your house to as many showings as possible can really help you capitalize on all the extra buyer activity we see at this time of year.

Since buyer competition ramps up in the spring, buyers are going to want to move fast to see your house once they find your listing. And, if they see it and fall in love with it at a time they know they’re competing with other buyers, you may be more likely to get the offer you’re looking for on your home.

It’s understandable you want to keep the disruptions to your own schedule to a minimum, and you may be stressed about having to keep it clean, but it’s worth it. As an article from Investopedia explains:

“If someone wants to view your house, you need to accommodate them, even if it inconveniences you. Clean and tidy the house before every single visit. A buyer won’t know or care if your house was clean last week. It’s a lot of work, but stay focused on the prize.”

To figure out what’s best for you, your agent will walk you through options like the ones below. This list breaks things down, starting with what’s most convenient for buyers and getting less buyer-focused as the list goes on:

- Lockbox on the Door – A key is available via a lockbox, which makes it easy for agents to show the home to potential buyers. This gives the most flexibility because the key is on-site and convenient.

- Providing a Key to the Home – An agent would have to stop by an office to pick up the key with this option. This is still pretty convenient for showings, but not quite as simple.

- Open Access with a Phone Call – You allow a showing with just a phone call’s notice, which can be great for someone who sees your house while driving by.

- By Appointment Only – This gives you a more advanced warning so you can get the house tidied up and be sure you have somewhere else you can go in the meantime. But it’s also a bit more restrictive.

- Limited Access – You might go this route if you only want to have your house available on specific days or at certain times of day. But realize this is the most difficult and least flexible of the choices.

As an article from U.S. News Real Estate says:

“Buyers like to see homes on their schedule, which often means evenings and weekends. Plus, they want to be able to tour a home soon after they find it online, especially if they’re competing with other buyers. If your home can be shown with little or no notice, more prospective buyers will see it. If you require 24 hours’ notice, they may choose to skip your home altogether.”

Your agent is going to help you find the right path forward based on your schedule and what’s working for other sellers in your area. And if you’ve got a hardline on granting buyers more access or have interested out of town buyers that just can’t be there in person, your agent will get creative and help you explore other options like video tours, virtual showings, and more. For more information on selling your home click here.

Bottom Line

When it comes to selling your house, you want to be sure to get as much buyer activity as you can. Let’s connect to talk about which level of access helps make that possible.

What Factors Impact Interest Rates for Home Buying in Minneapolis?

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why?

The answer is complicated because there’s a lot that can influence mortgage rates. Here are just a few of the most impactful factors at play.

Inflation and the Federal Reserve

The Federal Reserve (Fed) doesn’t directly determine mortgage rates. But the Fed does move the Federal Funds Rate up or down in response to what’s happening with inflation, the economy, employment rates, and more. As that happens, mortgage rates tend to respond. Business Insider explains:

“The Federal Reserve slows inflation by raising the federal funds rate, which can indirectly impact mortgages. High inflation and investor expectations of more Fed rate hikes can push mortgage rates up. If investors believe the Fed may cut rates and inflation is decelerating, mortgage rates will typically trend down.”

Over the last couple of years, the Fed raised the Federal Fund Rate to try to fight inflation and, as that happened, mortgage rates jumped up, too. Fortunately, the expert outlook for inflation and mortgage rates is that both should become more favorable over the course of the year. As Danielle Hale, Chief Economist at Realtor.com, says:

“[M]ortgage rates will continue to ease in 2024 as inflation improves . . .”

There’s even talk the Fed may actually cut the Fed Funds Rate this year because inflation is cooling, even though it’s not yet back to their ideal target.

The 10-Year Treasury Yield

Additionally, mortgage companies look at the 10-Year Treasury Yield to decide how much interest to charge on home loans. If the yield goes up, mortgage rates usually go up, too. The opposite is also true. According to Investopedia:

“One frequently used government bond benchmark to which mortgage lenders often peg their interest rates is the 10-year Treasury bond yield.”

Historically, the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has been fairly consistent, but that’s not the case recently. That means, there’s room for mortgage rates to come down. So, keeping an eye on which way the treasury yield is trending can give experts an idea of where mortgage rates may head next.

Bottom Line

Whenever the Fed meets, experts in the industry will be keeping a close watch to see what they decide and what impact it’ll have on the economy. To navigate any mortgage rate changes and their impact on your moving plans, it’s best to have a team of professionals on your side.

Why Having Your Own Agent Matters When Buying New Construction

Why Having Your Own Agent Matters When Buying a New Construction Home

Finding the right home is one of the biggest challenges for potential buyers today. Right now, the supply of homes for sale is still low. But there is a bright spot. Newly built homes make up a larger percent of the total homes available for sale than normal. That’s why, if you’re craving more options, it makes sense to see if a newly built home is right for you.

But it’s important to remember the process of working with a builder is different than buying from a homeowner. And, while builders typically have sales agents on-site, having your own agent helps make sure you have proper representation throughout your homebuying journey. As Realtor.com says:

“Keep in mind that the on-site agent you meet at a new-construction office works for the builder. So, as the homebuyer, it’s a smart idea to bring in your own agent, as well, to help you negotiate and stay protected in the transaction.”

Here’s how having your own agent is key when you build or buy a new construction home.

Agents Know the Local Area and Market

It’s important to consider how the neighborhood and surrounding area may evolve before making your home purchase. Your agent is well-versed in the upcoming communities and developments that could influence your decision. One way a real estate agent can help is by reviewing the builder’s site plan. For example, you’ll want to know if there are any plans to construct a highway or add a drainage ditch behind your prospective backyard.

Knowledge of Construction Quality and Builder Reputation

An agent also has expertise in the construction quality and reputation of different builders. They can give you insights into each one’s track record, customer satisfaction, and construction practices. Armed with this information, you can choose a builder known for consistently delivering top-notch homes.

Assistance with Customization and Upgrades

The most obvious benefit of opting for new home construction is the opportunity to customize your home. Your agent will guide you through that process and share advice on the upgrades that are most likely to add long-term value to your home. Their expertise helps make sure you focus your budget on areas that will give you the greatest return on your investment later.

Understanding Builder Negotiations and Contracts

When it comes to working with builders, having a skilled negotiator on your side can make all the difference. Builder contracts can be complex. Your agent can help you navigate these contracts to make sure you fully understand the terms and conditions. Plus, agents are skilled negotiators who can advocate for you, potentially securing better deals, upgrades, or incentives throughout the process. As Realtor.com says:

“A good buyer’s agent will be able to review any contracts before you sign on the dotted line, ensuring you aren’t unwittingly agreeing to terms that only benefit the builder.”

Bottom Line

If you are interested in buying or building a new construction home, having a trusted agent by your side can make a big difference. If you’d like to start that conversation, let’s connect.

Confused About Latest Home Price Headlines?

Don’t Let the Latest Home Price Headlines Confuse You

Based on what you’re hearing in the news about home prices, you may be worried they’re falling. But here’s the thing. The headlines aren’t giving you the full picture.

If you look at the national data for 2023, home prices actually showed positive growth for the year. While this varies by market, and while there were some months with slight declines nationally, those were the exception, not the rule.

The overarching story is that prices went up last year, not down. Let’s dive into the data to set the record straight.

2023 Was the Return to More Normal Home Price Growth

If anything, last year marked a return to more normal home price appreciation. To prove it, here’s what usually happens in residential real estate.

In the housing market, there are predictable ebbs and flows that take place each year. It’s called seasonality. It goes like this. Spring is the peak homebuying season when the market is most active. That activity is usually still strong in the summer, but begins to wane toward the end of the year. Home prices follow along with this seasonality because prices grow the most when there’s high demand.

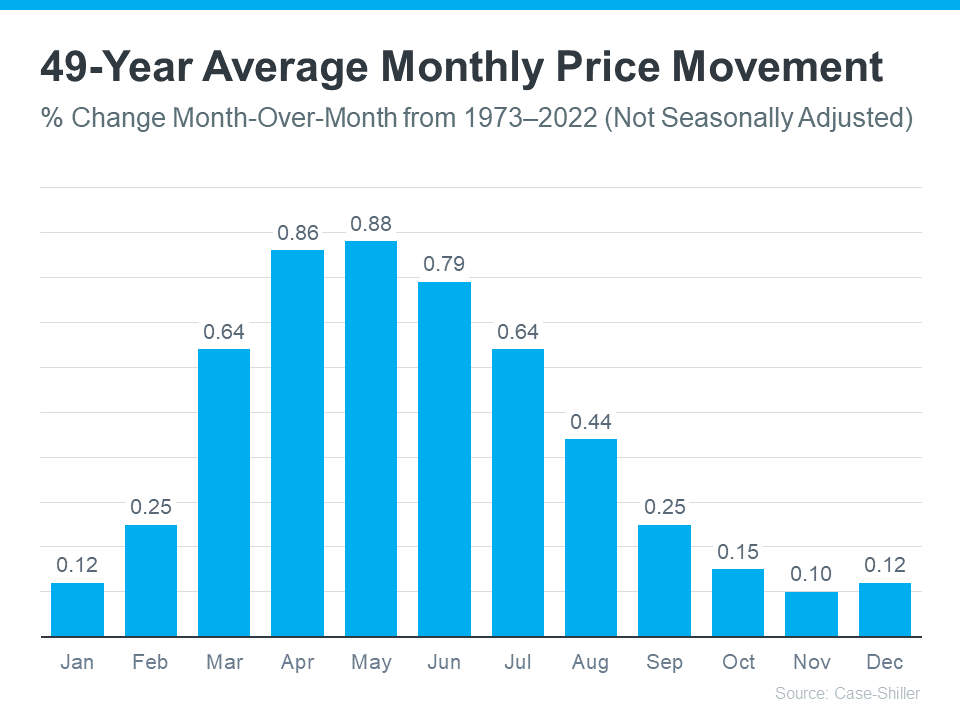

The graph below uses data from Case-Shiller to show how this pattern played out in home prices from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, for nearly 50 years, home prices match typical market seasonality. At the beginning of the year, home prices grow more moderately. That’s because the market is less active as fewer people move in January and February. Then, as the market transitions into the peak homebuying season in the spring, activity ramps up. That means home prices do too. Then, as fall and winter approach, activity eases again and prices grow, just at a slower rate.

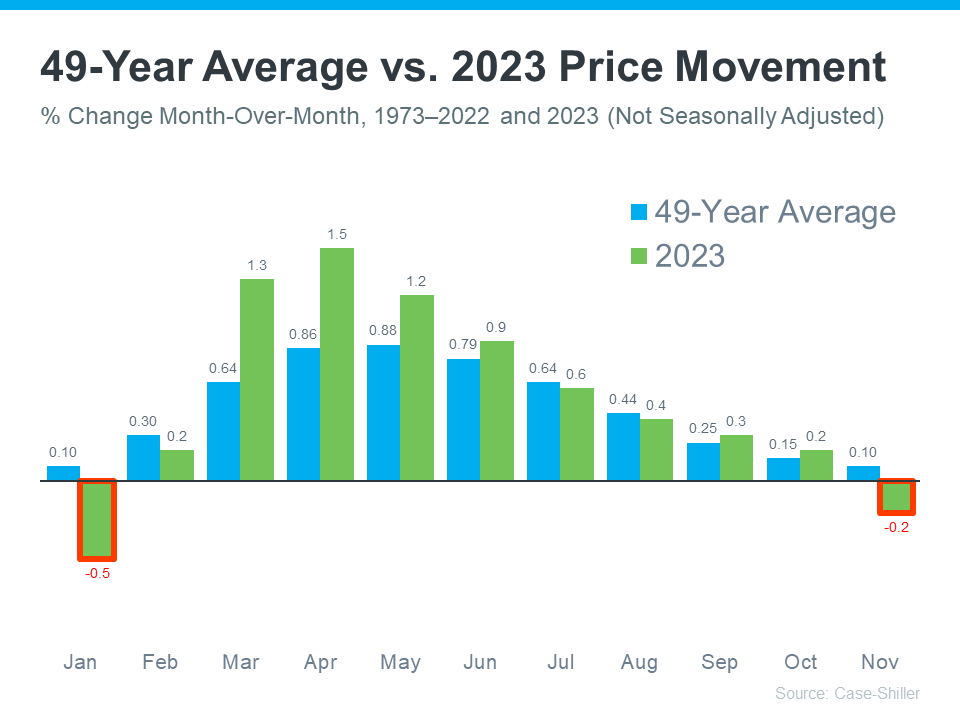

Now, let’s layer the data that’s come out for 2023 so far (shown in green) on top of that long-term trend (still shown in blue). That way, it’s easy to see how 2023 compares.

As the graph shows, moving through the year in 2023, the level of appreciation fell more in line with the long-term trend for what usually happens in the housing market. You can see that in how close the green bars come to matching the blue bars in the later part of the year.

But the headlines only really focused on the two bars outlined in red. Here’s the context you may not have gotten that can really put those two bars into perspective. The long-term trend shows it’s normal for home prices to moderate in the fall and winter. That’s typical seasonality.

And since the 49-year average is so close to zero during those months (0.10%), that also means it’s not unusual for home prices to drop ever so slightly during those times. But those are just blips on the radar. If you look at the year as a whole, home prices still rose overall.

What You Really Need To Know

Headlines are going to call attention to the small month-to-month dips instead of the bigger year-long picture. And that can be a bit misleading because it’s only focused on one part of the whole story.

Instead, remember last year we saw the return of seasonality in the housing market – and that’s a good thing after home prices skyrocketed unsustainably during the ‘unicorn’ years of the pandemic.

And just in case you’re still worried home prices will fall, don’t be. The expectation for this year is that prices will continue to appreciate as buyers re-enter the market due to mortgage rates trending down compared to last year. As buyer demand goes up and more people move at the same time the supply of homes for sale is still low, the upward pressure on prices will continue.

Bottom Line

Don’t let home price headlines confuse you. The data shows that, as a whole, home prices rose in 2023. If you have questions about what you’re hearing in the news or about what’s happening with home prices in our local area, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link